https://idxdigitalassets.com/wp-content/uploads/2022/11/FTX-whats-next.png

292

858

Ben

https://idxdigitalassets.com/wp-content/uploads/2022/08/imageedit_1_3451532283.png

Ben2022-11-14 13:47:202022-11-15 09:49:52FTX Blowup and What it means for Crypto?

https://idxdigitalassets.com/wp-content/uploads/2022/11/FTX-whats-next.png

292

858

Ben

https://idxdigitalassets.com/wp-content/uploads/2022/08/imageedit_1_3451532283.png

Ben2022-11-14 13:47:202022-11-15 09:49:52FTX Blowup and What it means for Crypto?What is Crypto Banking?

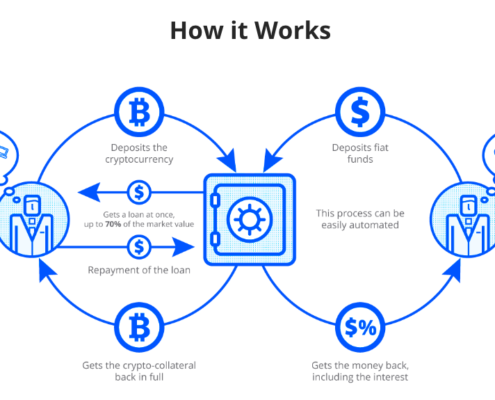

Crypto banking describes the process through which cryptocurrencies flow throughout the market and can be used for all kinds of transactions such as buying, selling, lending and borrowing. Crypto banks, otherwise known as decentralized financial protocols, process digital-money related transactions such as borrowing, lending saving etc. Whilst decentralized financial instruments attempt to completely reinvent and improve the banking industry, the hierarchy of value remains quite similar to traditional banking systems.

Layers in the Hierarchy of Money

At the very top of the hierarchy of money is a base commodity from which value is derived. Throughout history there have been numerous commodities that have been used as a base commodity for a store of value. Gold has been the most common store of value over time and has.

There are many examples of civilizations who have used gold as a store of value. The most recent of which was the US financial system whilst under the gold standard. In the gold standard, unsurprisingly Gold was at the top of the monetary hierarchy; Gold is quite secure but difficult to transact with. To make gold easier to transact with, a second layer was added to the system in the form of IOU’s issued by the federal reserve system.

The third layer on this system was where the bank would take the federal reserve notes and give the customer bank deposits. Layer 2 and Layer 3 solutions were placed on top of the gold standard because it simplified the movement of money between banks and made it much more efficient; now instead of having to transport large quantities of gold which is expensive and time consuming. Now they could simply exchange Federal Reserve Notes rather than actual physical gold.

How the Hierarchy of Money Effects Crypto Banking

A remarkably similar hierarchy of money can be seen in the decentralized financial system, however, with Bitcoin being the Layer 1 store of value rather than gold. Bitcoin stored on centralized exchanges such as Coinbase or Binance are part of Bitcoin’s “Layer 2”. When you store your Bitcoin on an exchange you do not technically hold the Bitcoin, you essentially own an IOU from the exchange for your bitcoin. Some exchanges like Kraken offer a proof of reserve for their customers which helps maintain transparency on Kraken’s reserves. This is known as full reserve banking because exchanges should always have enough bitcoin in stock to pay back any IOUs issued.

Like centralized exchanges, crypto borrowing and lending platforms such as Nexo, BlockFi and Celsius are all layer 2 solutions on the Bitcoin standard. When you deposit your Bitcoin to one of these lending platforms, you are giving them control over your Bitcoin. They then can do whatever they like with your Bitcoin such as loan it out to other third parties to earn some yield. These lending platforms use a fractional reserve system meaning they don’t always have enough Bitcoin to cover all of the IOUs issued.

The third and final aspect of layer 2 functionality of bitcoin is wrapped Bitcoin (wBTC). Wrapped Bitcoin is BTC which is available on the Ethereum network. Protocols such as Ren allow you to wrap your bitcoin from the Bitcoin network to the Ethereum network. You send them your Bitcoin; they store your Bitcoin and issue you wBTC backed 1;1 with the amount of BTC deposited.

Once you have wrapped your Bitcoin, you now can unlock layer 3 in the monetary hierarchy of the decentralized financial system by using your wBTC to earn yield in popular DeFi protocols such as Yearn Finance or Aave. Once you deposit your wBTC to Aave, you are issued an IOU with an interest rate while the protocol uses your assets to loan out to other customers in order to earn yield.

Hierarchy of the Dollar System

After the US dropped the Gold standard, the US dollar rose to be the global reserve currency and remains so today. The US dollar replaced Gold as the layer 1 store of value in the financial system and further layers were built on top of the petro-dollar system such as commercial bank deposits and Eurodollars. Eurodollars represent bank deposits from banks which do not have direct access to the fed. In more recent years a new form of dollar has emerged; the cryptodollar.

Cryptodollars are the newest layer in the US dollar financial hierarchy. Cryptodollars, or stablecoins are tokens which are backed 1:1 with the US dollar. There are a variety of Eurodollars to choose from, each with their own unique ways of maintaining their peg to $1. USDC, which is managed by Coinbase and Circle uses a full reserve banking system, meaning that it maintains $1 in its reserves for every $1 worth of USDC issued. Other cryptodollars such as UST and Ampleforth are algorithmic stablecoins. This means they use custom algorithms coupled with unique tokenomics to ensure the peg to $1 is maintained. DAI is the stablecoin of the Maker ecosystem. DAI maintains its peg by encouraging proper behavior from users within the Maker ecosystem.

Conclusion

With the rise of cryptocurrency, the rise of crypto banking is inevitable. Crypto banking has a real opportunity to change the world for the better. Not only do they provide opportunities to earn high yield on crypto native digital assets, but they also provide investors and even your average person who’s looking to save a few dollars the opportunity to earn a high interest yield on their Cryptodollars by depositing their assets to protocols such as Aave. Not only do these crypto banks offer a higher yield return on your deposits, but they are also leaps and bounds ahead of the traditional banking sectors in terms of efficiency and cost effectiveness. Because of the decentralized, open sourced, permissionless nature of DeFi applications, they are much more cost-effective entities to run because they cut out a large number of the middlemen needed by traditional financial players, thus saving cost and making a much more efficient system. Despite not being as efficient as the DeFi protocols, more centralized crypto banking services such as Celsius and BlockFi offer customers much higher yield than any traditional banking product. Crypto is here to stay and the crypto banking sector is going to see massive growth along with it.

Other Insights Posts

Ethereum 2.0 & EIP-1559: What it All Means for ETH

Ethereum 2.0 & EIP-1559: What it All Means for ETH