FTX Updates:

As most of us have already read alot of the headlines surrounding this debacle, we’ll opt for a truncated (and curated) summary below…and then offer our insights regarding

(i) why we stayed away from FTX (which many, including reporters, have asked us) as well as

(ii) our outlook (which is not as bad as many would think).

First, here’s a great timeline from our friends at Coindesk on how this unfolded:

So, this brings us to last Friday (11/11), when FTX (and their sister trading firm Alameda) filed for “voluntary” Chapter 11 bankruptcy and brought in a liquidation specialist as CEO (actually the same guy that presided over the Enron liquidation):

Sequoia Capital wrote down their entire $150M investment:

Here is the note we sent to our LPs in GGFIII regarding FTX. pic.twitter.com/Cgp1Yxk1pz

— Sequoia Capital (@sequoia) November 10, 2022

…given the large deficiencies that have now come to light, this (not surprisingly) kicked off a round of questions into how a firm like Sequoia got duped so badly:

source: https://www.bloomberg.com/news/newsletters/2022-11-10/sam-bankman-fried-sbf-was-seen-by-vcs-as-a-model-founder-at-ftx

This has also resurfaced concerns with the distinct Silicon-Valley-centric obsession with the “hero founder” complex that drives many (or seemingly all) of VC investment decisions…but that’s beside the point…

…It Gets Worse…

Later on Friday night, roughly $600M of assets were apparently “hacked” including the FTX app itself:

This obviously made a (very) bad situation worse and kicked off contagion concerns among groups that had exposure to FTX funds (which are now almost certainly all but gone entirely).

Contagion Comes…

The FTX collapse will certainly put several hedge funds and VC funds out of business…both those that had balances on the exchange as well as those that held its native token (FTT). It also put a spotlight on other exchanges themselves….notably another big name (that’s also fond of superbowl commercials) Crypto.com:

…there was also the small matter of Crypto.com “accidentally” sending $400M to the wrong wallet address…

As this played out over the weekend, investors woke up on Monday to see that the HK exchange Huobi is under pressure after the CEO had to get a loan to cover users’ funds which were on FTX (raising the question “why, exactly, were they there in the first place?“):

Why didn’t IDX have any FTX exposure?

This is a question we’ve gotten even before this debacle unfolded since, after all, FTX was apparently the gold-standard. The answer is 2-part:

(i) FTX was a largely unregulated offshore exchange…so as an SEC-regulated asset manager…and one that is focused on risk-management…despite the fact that FTX was a darling in the institutional landscape (an image they carefully cultivated), their “black box” nature was well-known and while it might have been a source of intrigue among the VC crowd, it raised too many questions & concerns for any SEC-compliant, US asset manager.

(ii) the second, and perhaps (now) more important reason was that we never liked the fact that FTX was run by a competing hedge fund (Alameda)….especially in a regulatory-light jurisdiction. That never passed the smell test for us and, frankly, we’re surprised it did for other hedge funds…. If the “secret sauce” of Alameda was ostensibly HFT & and arbitrage why would we let them see our trades?

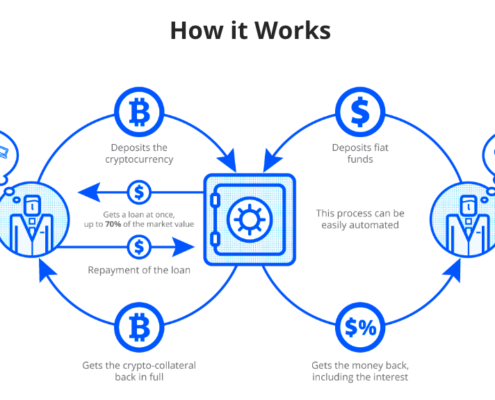

…of course, we had some questions as to their “sophistication” years ago…but ultimately chalked it up to them deliberately “dumbing down” a promo video so as to preserve their “edge”.

I remember watching this back then with the team and literally asking out loud “what am I missing here?” https://t.co/MNhHXxMjoW

— Ben McMillan (@bmcmillan888) November 12, 2022

What does this mean for Crypto?

This is obviously very bad for many parties. This includes many in the US regulatory and Political establishment given that SBF was a VERY large political donor and was actively crafting legislation that many in the industry saw as blatantly anti-competitive. It’s increasingly looking like the only “alpha” they ever had was of the political variety…

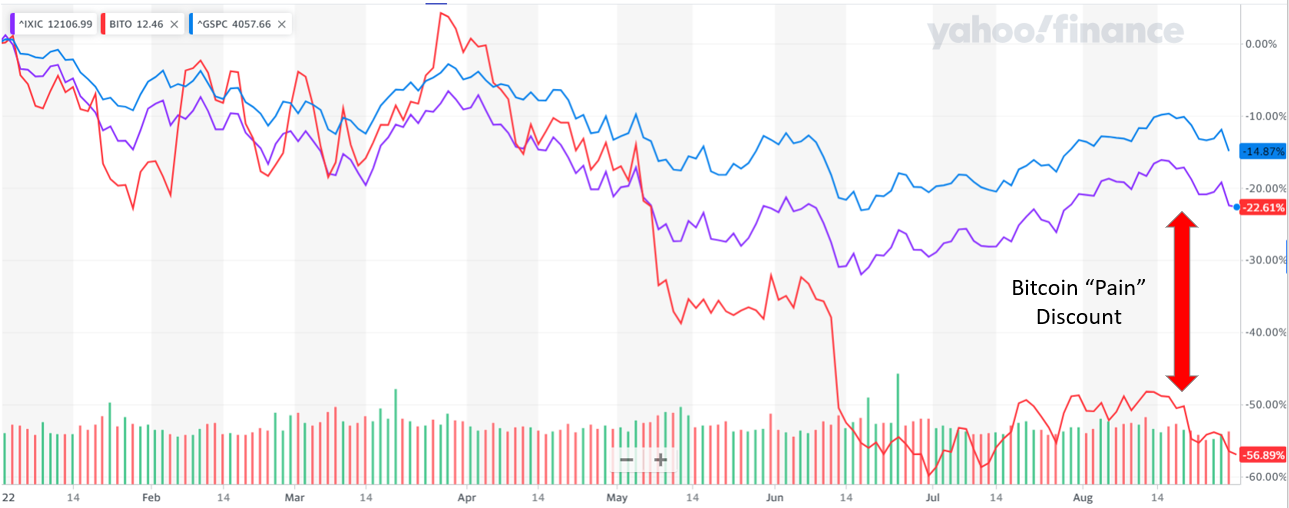

Regardless, this is likely going to sour many large institutional investors on the space for awhile. The headline risk has now increased as the internal Sequoia memo continues to go viral. Many of the large institutional investors that have been caught off guard by this will likely have Q4 investment committee meetings where they seek to mitigate “crypto risk” exposures for the time-being.

I remember a very similar sentiment after both Madoff and MF Global….

To that point, this blow-up actually looks very much like some combination of Madoff (ponzi scheme) and MF Global (improper use of client deposits)….neither of which is crypto-specific….and neither of which will be solved with crypto-specific regulation. That’s not to say that the space doesn’t need regulation (it does)…but that was known prior to this blow-up and there are already many good bi-partisan initiatives moving in that direction (SBF’s bill NOT being one of them).

This also isn’t blunting any of the development that’s been happening in the space. Projects are moving forward. Big names are building on the blockchain. Also, we must note, the DeFI exchanges powered by smart-contracts (in which all participants can see exactly what’s happening) ran into no issues. The transparency of blockchain is actually what allowed the crypto community to almost immediately detect the FTX hack and subsequent contagion effects so quickly and efficiently. It’s the un-regulated, centralized exchanges which can hide liabilities & lie to users/regulators.

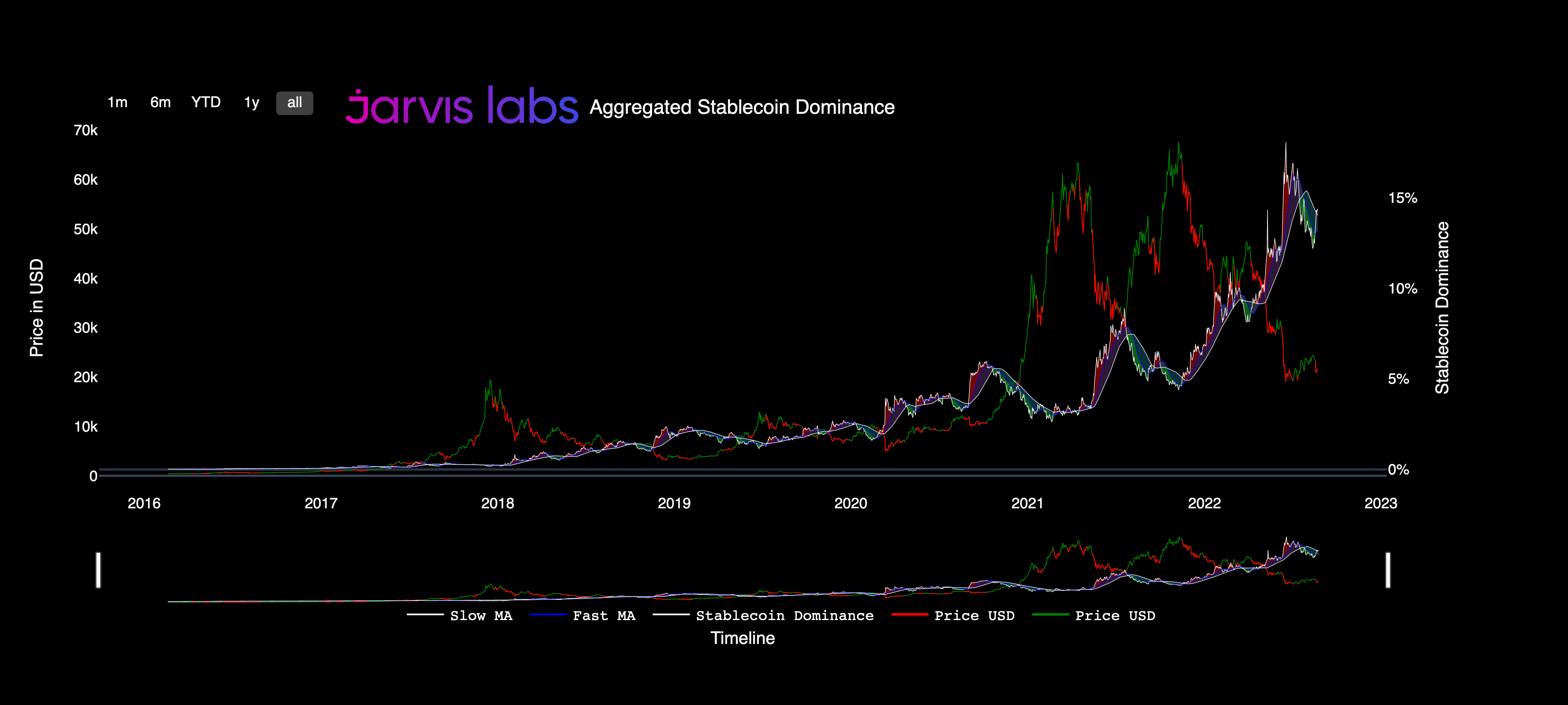

Given the macro backdrop and the knock-on contagion effects that have yet to materialize, this is an environment that could easily see further downside. Many technical analysts have been calling for a “re-test” of the $12-$13k range and while the ultimate “bottom” remains to be seen, 3 things we do firmly believe is that

(i) crypto is here to stay

(ii) it still has very compelling upside relative to other asset classes

(iii) a risk-managed approach is a prudent approach for participation

For those who are looking to learn more about Bitcoin, specifically how to talk to clients about the digital asset and it’s potential value in asset allocation models, we put together a high-level guide called “The Fiduciary’s Guide to Bitcoin and Blockchain”. Click on the button to the right to head to access the guide.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/XZNUSOWYFBEADGHY55FPLK4U7E.png)