https://idxdigitalassets.com/wp-content/uploads/2022/11/FTX-whats-next.png

292

858

Ben

https://idxdigitalassets.com/wp-content/uploads/2022/08/imageedit_1_3451532283.png

Ben2022-11-14 13:47:202022-11-15 09:49:52FTX Blowup and What it means for Crypto?

https://idxdigitalassets.com/wp-content/uploads/2022/11/FTX-whats-next.png

292

858

Ben

https://idxdigitalassets.com/wp-content/uploads/2022/08/imageedit_1_3451532283.png

Ben2022-11-14 13:47:202022-11-15 09:49:52FTX Blowup and What it means for Crypto?June 7th, 2022

As of writing, Bitcoin is bouncing around $30k…

…and there’s a renewed focus on regulation and “Quantitative Tightening” which means the days of easy money for low quality projects are over.

The question we routinely get from investors is “is the bottom in?“.

The answer, as is always the case with crypto assets is: “it can always go lower”.

This is an asset class in which risk-management needs to be front and center for any practitioner…and this year is a stark reminder of that fact to investors.

So – where do we go from here?

Risk-assets (in general) and Bitcoin (in particular) have been pressured by a tough macro environment. This includes an end to both ZIRP (“Zero Interest Rate Policy”) as well as Quantitative Easing. As a result, a lot of growth-oriented exposures (like high-multiple tech stocks and crypto assets) have been hit the hardest…after all, when the value of an asset is further in the future (like growth stocks or digital assets) as opposed to near-term (like dividend paying stocks) then even a relatively small increase in interest rates has a disproportionate effect on the discount rate for that future cash flow.

For crypto-assets, especially, this is very much like the 90’s “dot com” boom when literally any company with a “.com” at the end was a moonshot. After a meteoric rise in the late 90’s, the NASDAQ fell back to earth in the early 2000’s. At one point, both Pets.com and Amazon.com were down 90%….one went out of business and the other went on to become an industry unto itself.

The crypto ecosystem is going through a similar washout in which capital is becoming more discerning and only the quality projects with real utility will survive. The words “blockchain” and “disruption” are no longer sufficient enough for a handful of anonymous programmers to raise $100M and launch a token….and like the late 90’s tech scene, this is good for creating durable value long-term.

Like the early 2000’s…this could prove to be a generational opportunity to invest in quality digital assets:

Nasdaq Composite Index

Source: Yahoo Finance

It’s important to always remember the first rule (above) of investing in crypto...it can always go lower.

This is not to call the bottom. It is, however, useful for investors to zoom out and take stock of the greater potential long-term opportunity – particularly after asset values have sold off significantly.

Being optimistic on the long-term potential for an asset class while remaining cognizant of the downside risks is the exact reason we believe in taking a risk-focused approach to digital assets. By attempting to separate risk regimes – and then varying the exposure accordingly – we seek to remove some (or most) of the downside over time while still providing upside exposure.

Separating the Risk Regimes

Who’s Buying vs. Selling?

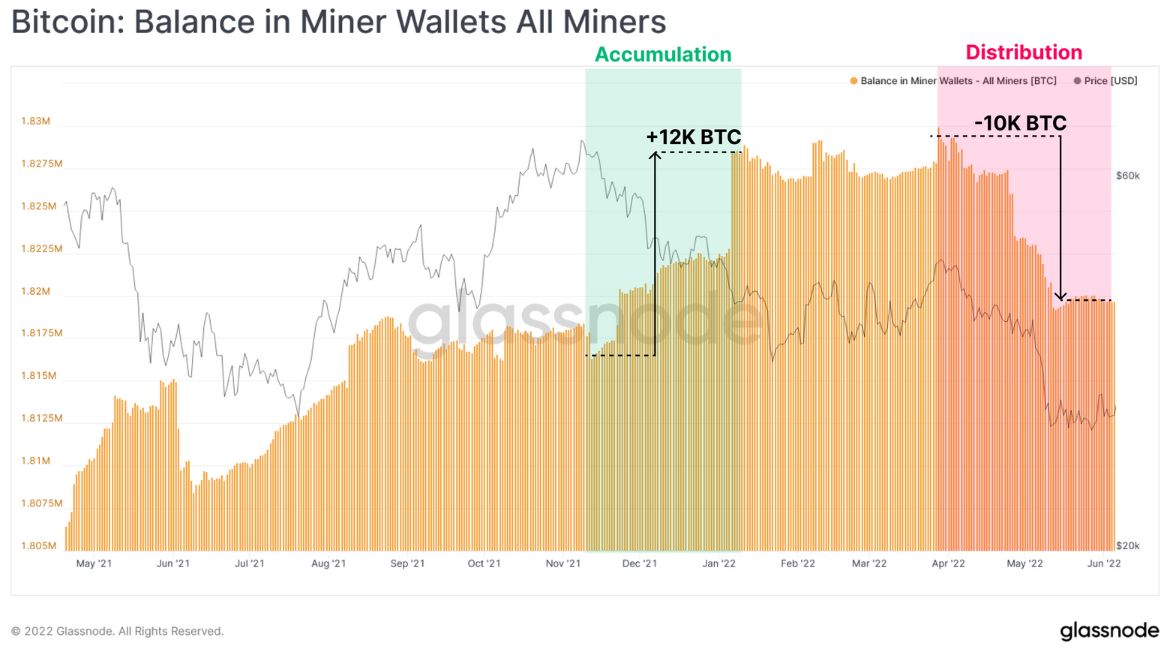

One of the advantages of blockchain technology is the transparency afforded to investors who are able to take advantage of that fact. Tracking the wallets of exchanges vs. miners vs. VC’s can provide some interesting insights into the supply and demand dynamics at play. In particular, recently we’ve seen 2 dominant themes play out:

- Newer wallets are selling to older wallets

- Miners are under stress

Newer wallets selling out to older vintage wallets isn’t terribly surprising. Particularly, when one considers the relatively large influx of new bitcoin investors towards the end of last year (at or near all time highs)….many of whom probably weren’t mentally prepared for an immediate 50% drawdown. As a result these wallets were quick to cut bait while those that have been around for awhile are happy to buy those bitcoins at these levels.

More interesting (perhaps) is the miners’ selling of late. As we mentioned in a recent piece in Kitco “Miners can get away with higher cost electricity when Bitcoin is at $60,000, but when Bitcoin is at $30,000, costs of your electricity and your hardware start to matter a lot more.”

As miner profitability comes under pressure, this can actually end up being constructive for supply dynamics as the less profitable operations simply choose not to mine until the price of Bitcoin comes back up. As a result this reduces the incremental rate of supply…not unlike certain oil rigs going dark until the price of oil rises back above their marginal cost of production.

Final Thoughts

This “dot com” moment for crypto assets is ultimately a good thing for prudent investors just as it was for technology stocks decades ago. The long-term bull case for digital assets and blockchain technology is only getting stronger…but, like tech stocks after the dot-com bust, quality matters.

Meme tokens weren’t a sound investment at any price and they won’t be going forward at any price. We suspect in 20 years investors will look back at this period as a generational opportunity to establish exposure to digital assets (and with the appropriate Pets.com vs. Amazon reference)….the question is, who will have taken advantage of it?

This report was prepared by IDX Advisors, LLC (“IDX”), a federally registered investment adviser under the Investment Advisers Act of 1940. Registration as an investment adviser does not imply a certain level of skill or training.

All information is strictly as of the date indicated and does not reflect positioning or characteristics averaged over any period. All information referenced is for strictly information purposes only, and this piece should not be construed as a recommendation to purchase or sell the security referenced. Investing in any security, including the securities presented in this presentation, involves the potential loss of principal, and past performance it not necessarily indicative of future results.

This is prepared for informational purposes only. It does not address specific investment objectives, or the financial situation and the particular needs of any person who may receive this report.

An index is an unmanaged portfolio of specific securities, the performance of which is often used as a benchmark in judging the relative performance of certain asset classes. Investors cannot invest directly in an index. An index does not charge management fees or brokerage expenses, and no such fees or expenses were deducted from the performance shown.

Hypothetical or model performance results have certain limitations including, but not limited to: hypothetical results do not take into account actual trading and market factors (such as liquidity disruptions, etc.). Simulated performance assumes frictionless transaction costs and no lag between signal generation and implementation. Simulated performance is designed with the benefit of hindsight and there can be no assurance that the strategy presented would have been able to achieve the results shown. There are frequently large differences between hypothetical performance results and actual results from any investment strategy. While data was obtained from sources believed to be reliable, IDX and its affiliates provide no assurances as to its accuracy or completeness.

For those who are looking to learn more about Bitcoin, specifically how to talk to clients about the digital asset and it’s potential value in asset allocation models, we put together a high-level guide called “The Fiduciary’s Guide to Bitcoin and Blockchain”. Click on the button to the right to head to access the guide.

Pivot, Pain & Powell….What Does This Mean for Crypto?

Pivot, Pain & Powell….What Does This Mean for Crypto?