https://idxdigitalassets.com/wp-content/uploads/2022/11/FTX-whats-next.png

292

858

Ben

https://idxdigitalassets.com/wp-content/uploads/2022/08/imageedit_1_3451532283.png

Ben2022-11-14 13:47:202022-11-15 09:49:52FTX Blowup and What it means for Crypto?

https://idxdigitalassets.com/wp-content/uploads/2022/11/FTX-whats-next.png

292

858

Ben

https://idxdigitalassets.com/wp-content/uploads/2022/08/imageedit_1_3451532283.png

Ben2022-11-14 13:47:202022-11-15 09:49:52FTX Blowup and What it means for Crypto?As of writing, Bitcoin just topped $65k to hit an all-time high…

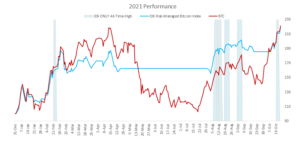

As the ProShares Bitcoin Strategy ETF (BITO) launches this week, there has been a plethora of speculation about bitcoin hitting its all time high. Our IDX Risk-Managed Bitcoin Index, however, hit an all-time-high last week (and again today)…how is this possible? It comes back to the idea of capital efficiency. If the drawdowns are less frequent and more shallow, then your capital doesn’t need to work nearly as hard to get back to (and eventually past) all time highs.

Investors tend to get dollar signs in their eyes when it comes to bitcoin…and for good reason. But return is only part of the story (and the less important part)…the risk that had to be taken to get that return is the most important component for long-term success. Our favorite way to measure this is simply comparing severity and duration of drawdowns between two time series:

…but it’s also instructive to look at the upside too…how often is the IDX Risk-Managed Index making All-Time-Highs while Bitcoin is NOT?

As it turns out, this year, the index has made a new high 11 times while Bitcoin was still in a drawdown. As you can see in the graph above, because the index didn’t chase returns earlier in the year (because that environment was determined NOT to be a “compensated risk” environment), it therefore didn’t participate in the subsequent 50% drawdown…which means, the capital didn’t have to “work” as hard to get back to all-time-highs.

As we’re fond of saying…”Worry about the downside and the upside will take care of itself”.

Hypothetical or model performance results have certain limitations including, but not limited to: hypothetical results do not take into account actual trading and market factors (such as liquidity disruptions, etc.). Simulated performance assumes frictionless transaction costs and no lag between signal generation and implementation. Simulated performance is designed with the benefit of hindsight and there can be no assurance that the strategy presented would have been able to achieve the results shown. There are frequently large differences between hypothetical performance results and actual results from any investment strategy. While data was obtained from sources believed to be reliable, IDX Insights, LLC (“IDX”) and its affiliates provide no assurances as to its accuracy or completeness.

For those who are looking to learn more about Bitcoin, specifically how to talk to clients about the digital asset and it’s potential value in asset allocation models, we put together a high-level guide called “The Fiduciary’s Guide to Bitcoin and Blockchain”. Click on the button to the right to head to access the guide.

Bitcoin’s Volatility is a Feature, Not a Bug

Bitcoin’s Volatility is a Feature, Not a Bug