https://idxdigitalassets.com/wp-content/uploads/2022/11/FTX-whats-next.png

292

858

Ben

https://idxdigitalassets.com/wp-content/uploads/2022/08/imageedit_1_3451532283.png

Ben2022-11-14 13:47:202022-11-15 09:49:52FTX Blowup and What it means for Crypto?

https://idxdigitalassets.com/wp-content/uploads/2022/11/FTX-whats-next.png

292

858

Ben

https://idxdigitalassets.com/wp-content/uploads/2022/08/imageedit_1_3451532283.png

Ben2022-11-14 13:47:202022-11-15 09:49:52FTX Blowup and What it means for Crypto?Understanding Risks in Digital Assets Lending

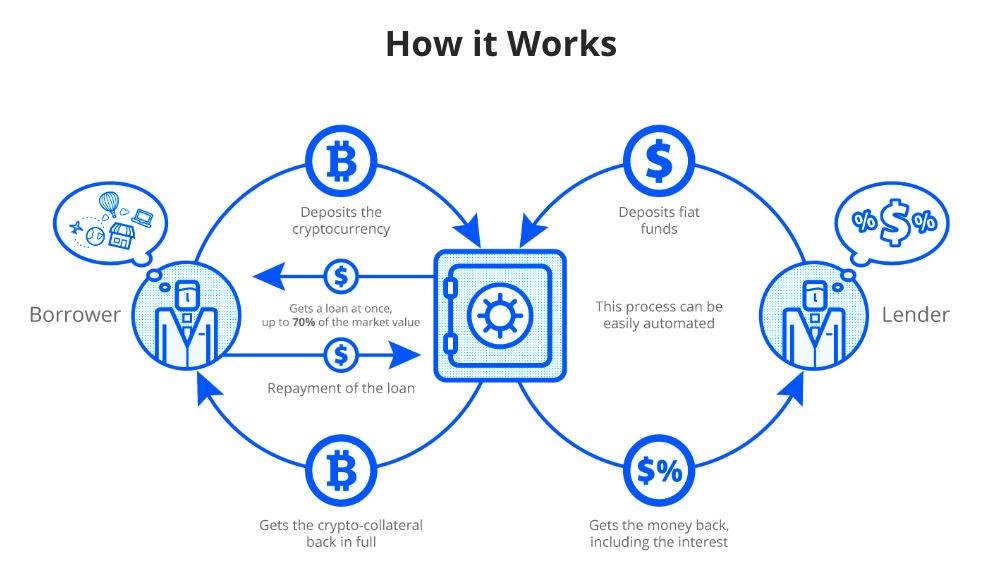

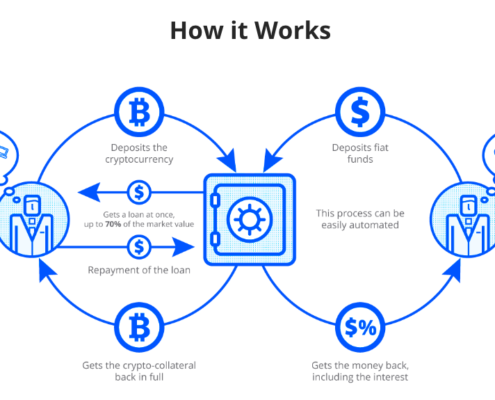

Decentralized Finance (“DeFi”) has emerged as a powerful force to be reckoned with. Over the last few years, dozens of DeFi protocols have been built to allow users to borrow, lend and trade crypto assets in a trustless, permissionless and custodial-free way. The amount of money actually using DeFi is not small, either. As of Q2 2021, over $60BN are in the DeFi ecosystem. One of the most exciting benefits of this is the ability for investors earn a yield by lending crypto assets that is much higher than can be had in traditional finance. Furthermore, this doesn’t require taking crypto-market risk; USD-pegged “stablecoins” can be lent at double-digit rates. With the ability to earn 12% on US dollars when banks are paying less than 2%, it’s no surprise investors have started to take notice. While lending stablecoins on a DeFi protocol may not involve the market risk of bitcoin, this is not to say there is no risk. The lack of a trusted intermediary is one of the defining characteristics of the DeFi ecosystem and while it brings with it a number of strengths, there are some notable drawbacks. The primary is the fact that there is no custodial or regulatory apparatus protecting investors against things like bad actors or carelessness. Protocol Lending provides great rewards, but they come with a degree of risk that investors must be aware of. What are these risks and how can investors seek to mitigate them?

Smart Contract Technical Failure

Lending protocols are coded by developers in the form of smart contracts. Because it’s so difficult to code 100% error free, there’s always some level of risk that the smart contract may not operate the way developers initially intended it to. This risk can be minimized through extensive testing and having the smart contracts audited by a third-party firm, such as CertiK.

Ensuring the smart contracts have been audited is crucial to ensuring protocol security. Smart contract audits are when a third-party reviews the code and tests for any bugs, vulnerabilities or errors in the business logic of the smart contracts. These audits allow errors in the code to be corrected before the smart contract is deployed.

Using battle-hardened protocol’s that have stood the test of time is one of the best ways minimize the risk of technical failure. Aave is the largest lending protocol in the DeFi landscape currently, with over $10 billion Total Value Locked at the time of writing. All their smart contracts have been audited by multiple different third-party firms to minimize any technical risks. Compound and Maker are the next biggest lending protocols in the DeFi space, these protocols also provide an audited, battle-hardened platform for investors to earn great yield in a low-risk environment.

While a technical risk like a protocol hack is considered high, the likelihood that such an event occurs for a protocol is relatively low. If such risks are of great concern for investors, they can seek out protection via insurance. Insurance providers like Nexus or Etherisc provide technical risk protection, typically to the tune of 1-2% of annual investor returns.

Economic Model Failure

A lot of the lending platforms in the DeFi space have their own economic models which is designed to incentivize good behavior by users. It’s this good behavior which helps to ensure the stability of protocols. A good example of this is MakerDAO.

MakerDAO’s stablecoin, DAI, is pegged 1;1 with the US dollar, it uses Ethereum as collateral to maintain the $1 peg. DAI uses various smart contracts to maintain DAI’s peg to 1 dollar by either increasing or decreasing the amount of Ethereum used as collateral. If the economic incentives of the network fail to promote good behavior by network users and the Ethereum price drops too far too quickly, it could potentially break the DAI’s peg to the US dollar.

External/Oracle Risks

There are some external factors which may pose some risks to the protocol. Smart contracts rely on Oracles to provide them with off chain data such as real time price feeds or the result of an event. There’s always a risk that oracles could provide false or malicious data which could have a negative effect on the protocol. These risks can be minimized by using platforms that use reliable decentralized oracle providers.

Blockchains and smart contracts are closed loop systems, meaning they only have access to on-chain data, or data that is available on the blockchain. This where oracles come in. Oracles are essentially data feeds that provide smart contracts with off-chain data, or data that is not available on the blockchain.

Oracles query and verify external data which is then fed to smart contracts. It’s important that protocols use secure, reliable oracles, this way protocols can ensure they get a constant stream of accurate external data for their smart contracts.

Chainlink has risen to become the industry standard oracle solution. Chainlink is an oracle network which currently provides over 500 blockchain platforms with access to reliable off-chain data feeds, without sacrificing the security inherent to blockchain technology. Ensuring a protocol uses Chainlink is a great way to minimize the risk of oracles providing malicious or inaccurate data. Chainlink is powered by it’s native token, LINK, which has quickly risen to be a top-10 token by market cap, driven by it’s competence and massive list of integrations in the DeFi space.

It is worth noting that unlike technical risk protection via insurance contracts, external oracle attacks can not be covered by insurance. Therefore, if an oracle attack does occur, the investor is responsible for any lost funds. Again, this is an unlikely occurrence, but this is another reason investors should do their due diligence in making sure their selected lending protocols work with secure oracles.

Conclusion:

Protocol Lending is a great innovation with the potential to completely change the financial space. Like everything else in finance, it has its inherent risks and rewards. It’s important that we understand the risks so we can minimize them, while maximizing the great rewards available from Protocol Lending.

Bitcoin ETFs: What Investors Need to Know About This Structure

Bitcoin ETFs: What Investors Need to Know About This Structure