https://idxdigitalassets.com/wp-content/uploads/2022/11/FTX-whats-next.png

292

858

Ben

https://idxdigitalassets.com/wp-content/uploads/2022/08/imageedit_1_3451532283.png

Ben2022-11-14 13:47:202022-11-15 09:49:52FTX Blowup and What it means for Crypto?

https://idxdigitalassets.com/wp-content/uploads/2022/11/FTX-whats-next.png

292

858

Ben

https://idxdigitalassets.com/wp-content/uploads/2022/08/imageedit_1_3451532283.png

Ben2022-11-14 13:47:202022-11-15 09:49:52FTX Blowup and What it means for Crypto?First, What Exactly is EIP-1559 as it Relates to Ethereum?

Similar to how Apple or Android would push a system update live, Ethereum is set to undergo a much anticipated update to its blockchain. That update is known as the Ethereum Improvement Protocol 1559, or EIP-1559.

One of the biggest impediments to Ethereum’s current scaling abilities is that its blockchain can often become congested trying to process transactions. We have seen this congestion steadily increase over the past 12 months or so, particularly with more and more decentralized apps (DApps) being built on the Ethereum blockchain, like the hugely popular decentralized exchange Uniswap, in which users pay their transaction fees in ETH.

Each transaction on the Ethereum blockchain is settled in groups or blocks (hence the name blockchain); if a block is full, meaning a transaction has taken precedence over yours, you will be passed along to the next block. Fees typically dictate your “spot in line” when miners are processing transactions. The higher the fee you are willing to pay, the higher in the queue you will be, and therefore the faster your transaction will take place.

What EIP-1559 will solve for the Ethereum blockchain is three-fold:

- It will double the size of the blocks, allowing for more, and faster, transactions.

- The update will create a publicly broadcasted fee schedule that users can rely on. Prior to EIP-1559, fees that were shown prior to a transactions were rough estimates, and sometimes, the user had to overpay to to use the network.

- A small amount of ETH will be “burned” in each transaction.

Prior to EIP-1559, fees that were shown, fees that were shown prior to a transaction were rough estimates, and sometimes, the user had to overpay to use the network.

In pushing the EIP-1559 upgrade live, Ethereum takes a big step towards becoming deflationary asset, since a small of amount of ETH will be burned in each transaction. This has been the most popular (and anticipated) part of the EIP-1559 update and for good reason; by increasing the scarcity of ETH, basic economics will dictate would dictate an increase in price (ceteris parabis). Early estimates believe that EIP-1559 will reduce ETH’s overall inflation rate from roughly 4% a year down to 3% a year. Though it sounds like a marginal difference, it is massive reduction in new ETH supply, which is always key when evaluating these digital assets as potential investments.

Eth 2.0 & Proof of Stake vs. Proof of Work

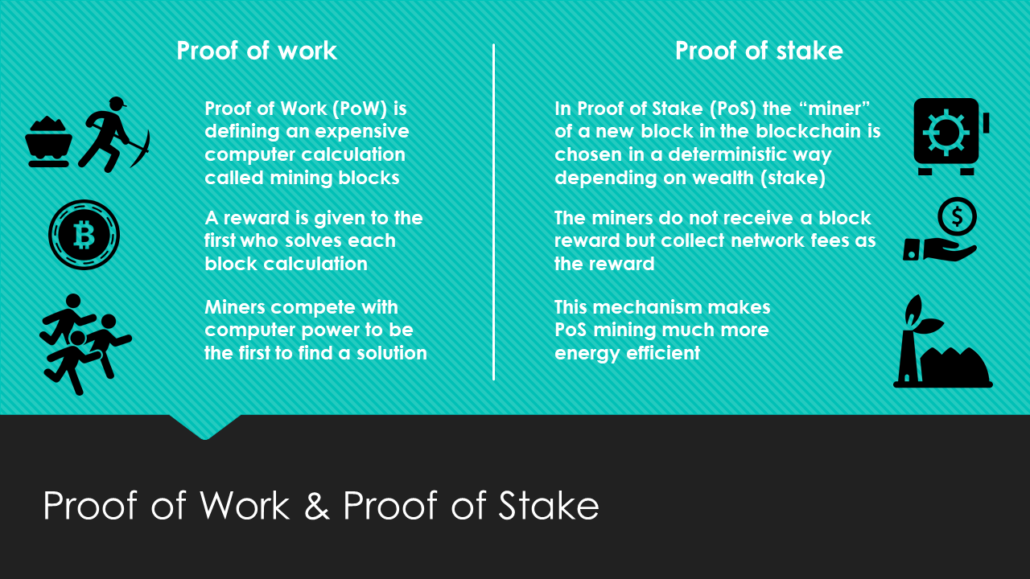

EIP-1159 is not the only major upgrade coming to Ethereum. While EIP-1559 moves ETH towards more of a consumable, usable (and deflationary) commodity, ETH 2.0 is set to flip the entire chain by moving from Proof of Work to Proof of Stake.

Public blockchain networks are open source, decentralized, distributed networks which means anybody can connect to the network and facilitate transactions on the network so long as they’re able to complete the consensus algorithm of the blockchain.

Consensus algorithms are what keeps nodes on the network in sync with each other to verify which transactions are legitimate and should be added to the blockchain. Ethereum currently uses a proof of work consensus mechanism however as part of the network upgrade to Ethereum 2.0, the Ethereum consensus mechanism is changing from proof of work (PoW) to proof of stake (PoS).

So what are the differences between PoW & PoS and what do these upgrades mean for the Ethereum Network?

Proof of Work (PoW)

Proof of Work is the consensus algorithm used currently on the Bitcoin and Ethereum networks. Nodes that are used on a PoW blockchain are usually referred to as miners. These miners use their computational power to solve complicated mathematical puzzles, whoever solves these complex mathematical puzzles first creates a block and gets rewarded. On the bitcoin network they get rewards in BTC and in ETH on the Ethereum network.

Proof of Stake (PoS)

In a proof of stake system, nodes are referred to as validators or validator nodes. Users deposit their tokens to a validator node, this guarantees their rights to validate transactions on the network. Once the tokens are deposited to the node, it then can begin to produce blocks. The PoS algorithm chooses at random which validator gets to create the next block and thus earn transaction fees. How many tokens locked and for how long they were locked are factors which determine whether a validator gets the rights to confirm a transaction.

Why would Ethereum move from PoW to PoS?

One reason for making the switch is energy usage. PoW requires a large amount of computational power to come to consensus as miners need to complete complicated mathematical puzzles, whereas in PoS there is no complicated mathematical equation to solve, validators are chosen at random. This makes PoS networks much more energy efficient than PoW networks, thus making them more cost effective to run.

Another reason to migrate to PoS is for network speed and scaling. Proof of stake can settle transactions much quicker than PoW. Staking will allow for the creation of shard chains on Ethereum. This allows Ethereum to create multiple blocks at the same time making it much more scalable.

It makes it much easier for people to run a node, you can participate in the network without having to buy a bunch of complicated, specialized hardware. All you need is the minimum of 32 ETH needed for staking, or an ETH holder can delegate their Ethereum to a pool. Because it’s much easier to participate in a Proof of Stake network, they can become much more decentralized than a Proof of Work network as anybody can become a validator without the expensive upfront costs of mining equipment. With all the recent environmental concerns of mining, Proof of Stake has also been gaining traction amongst the ESG community.

Conclusion

The migration of Ethereum to Ethereum 2.0 is an exciting development in the digital assets space, as is the soon-to-launch EIP-1559 update. The introduction of Proof of Stake to the Ethereum network should have a myriad of benefits to the network such as an increased decentralization, increased transaction speed, and lowered transaction costs, not to mention the environmental benefits of changing to a much more energy efficient system.

To learn more about IDX’s Risk-Managed Digital Asset Trust, head on over to our Trust Inquiry page.

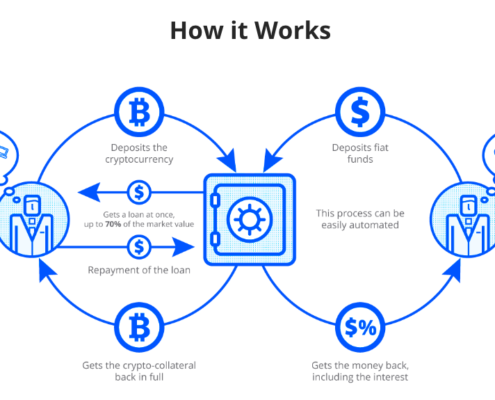

Understanding the 3 Primary Risks in Digital Assets Lending

Understanding the 3 Primary Risks in Digital Assets Lending