August 29th, 2022

As of writing, Bitcoin is back down around $20k…

Chairman Powell made his much anticipated comments at Jackson Hole last week and the markets, while expecting a somewhat hawkish tone, apparently weren’t expecting it to be quite so hawkish.

In particular, his comments that rates would likely be higher for some time (clearly his attempt at countering the expectation of a “Fed Pivot” that had been priced into the rates markets) coupled with his direct mention of “some pain” was enough to spook risk markets.

In all of this, it’s worth noting that he only used 10 minutes of his allotted 30.

So – What does this mean for Crypto?

2022 has been the year in which Crypto (in general) and Bitcoin (in particular) have been dominated by macro risks which have then been exacerbated by idiosyncratic (e.g. crypto-specific) risks.

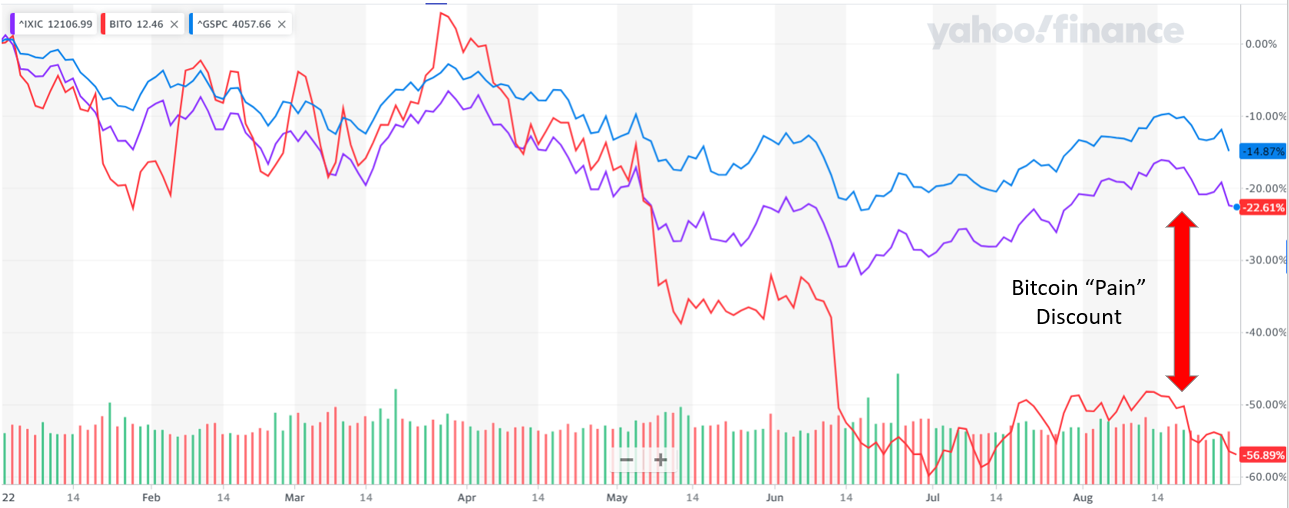

For example…if we just look at the first 5 months of this year, we see that bitcoin (as shown by the BITO ETF) basically traded like a higher-beta version of the S&P 500 or the Nasdaq….but in May we saw the crypto-specific risks came out of the shadows unleashing a liquidity cascade that crushed the price of bitcoin:

Source: Yahoo Finance

The combination of several large blowups (e.g. Three Arrows, Luna, Celsius, etc.) coupled with a general risk-off appetite resulted in any real bid for bitcoin disappearing leaving only the sellers left.

Now, as investors, we’re left to ask “Where does it go from here?”

In the short-term, there’s certainly the risk that markets trade lower. Many investors are expecting the equity markets to retest (or come close) to the June lows. What’s worth noting, however, is that bitcoin is already pretty close to its lows. Now, it could set new lows…but the point to be made is that there’s already a substantial “pain discount” built into bitcoin at these levels.

A Return to Risk

It’s important to always remember the first rule (above) of investing in crypto...it can always go lower.

This is not to call the bottom. It is, however, useful for investors to zoom out and take stock of the greater potential long-term opportunity – particularly after asset values have sold off significantly.

Being optimistic on the long-term potential for an asset class while remaining cognizant of the downside risks is the exact reason we believe in taking a risk-focused approach to digital assets. By attempting to separate risk regimes – and then varying the exposure accordingly – we seek to remove some (or most) of the downside over time while still providing upside exposure.

This doesn’t mean you’ll avoid all of the downside but it does mean that we should avoid much (if not most) of the downside. This, then, makes the trip back up much easier.

If you don’t have to carry a 100lb backpack out of the canyon, you can climb out much quicker…

A Reason to be Optimistic?

There are actually several.

The first is the structural bull case. To put it simply, blockchain technology has the potential to disrupt the world like the internet did…and it’s still early.

Remember back to the mid-90’s…more than a few people saw what the internet had the power to be and do to reshape our world….but the majority didn’t….because the applications weren’t built (or even conceived of) yet.

The Next Internet

Take a moment and listen to a young Bill Gates try to explain the internet to David Letterman in 1995….listen to how hilarious Letterman sounds when he responds with “Yeah but we have this thing called the radio“.

Then, appreciate the fact that you’re watching this on a cloud service accessed by a personal computer…in fact, more than 50% of you are probably reading this on a smartphone that has more computing power than NASA had when it sent a man to the moon. Back in 1995, the idea that everyone would have a “personal computer” was NOT commonplace….certainly not a personal computer that could fit in your hand…

The point is…all of this transformational technology (that we ALL take for granted) was literally laughed at in the early days:

Source: Youtube

Regulation

As if that isn’t enough…the second bit of good news is actually regulation…while this is bad for fringe or illicit actors, it’s actually good for investors.

Why? Because it legitimizes crypto…and in doing so, dramatically opens up the audience willing to participate in crypto. A lot of people still won’t touch the space because it’s too fringe (in their minds). Advancements like allowing CME regulated futures contracts (for example) have brought in investors who would’ve never otherwise participated because they didn’t want to try to custody spot themselves (or even allow someone else to do it). With the CME as their counterparty this risk goes away.

Similarly, federal standards around stablecoin providers (as another example) will make it easier for the population-at-large to access this space.

Stablecoin “Powderkeg”

Speaking of stablecoins…aside from providing the “plumbing” for many real-world use cases, they also are a useful indicator of so-called “dry powder” on the sidelines. For many investors/speculators, when they sell out of bitcoin (or any other crypto) they don’t cash out into USD…especially if they’re expecting to buy back in. Rather, they’ll park their cash in stablecoins and wait for the next opportunity to buy.

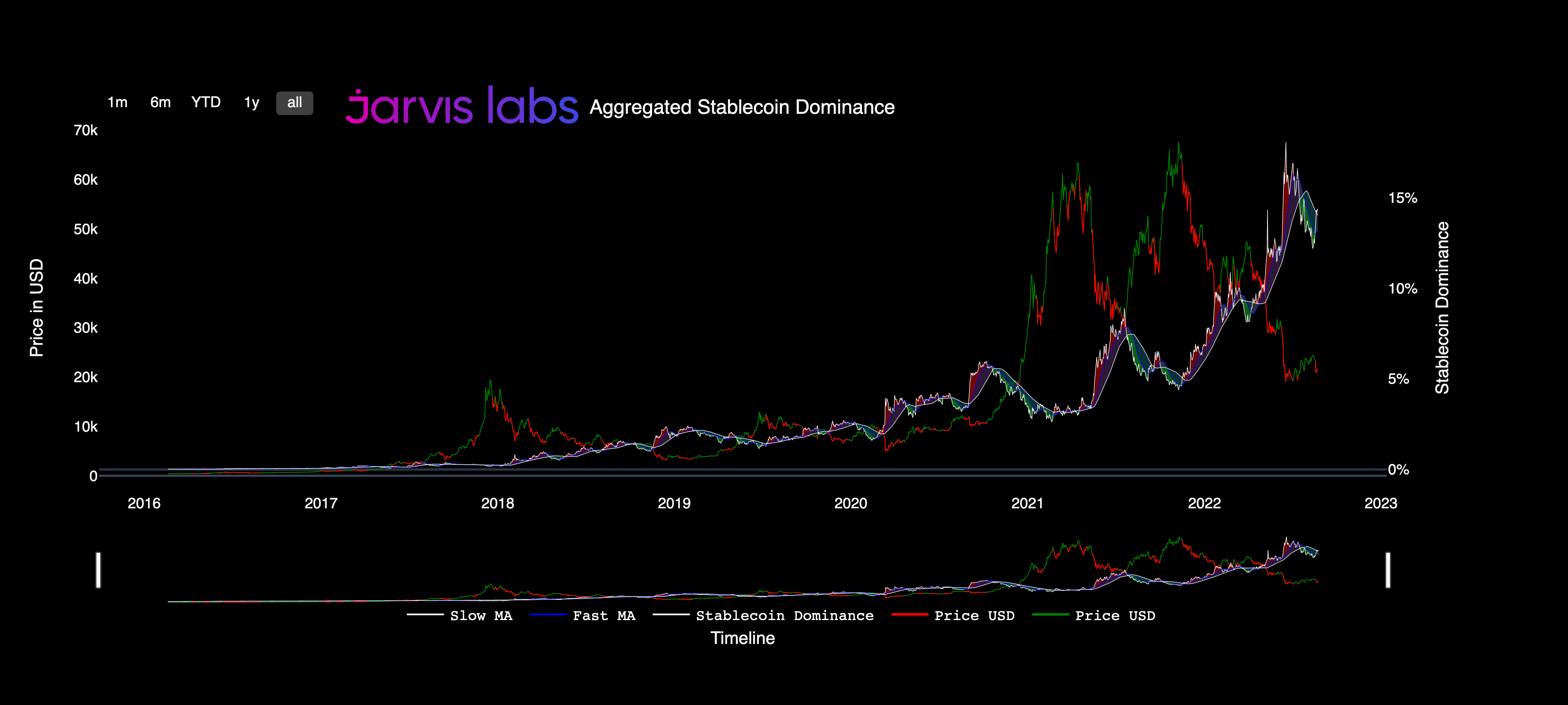

In this latest piece from our friends at Jarvis Labs titled (appropriately) A Powder Keg of Stablecoins (which is worth reading), they show just how BIG this powderkeg is:

Source: Jarvis Labs

Some notable observations:

“this shows us that most who’ve sold throughout 2022 haven’t off-boarded to fiat bank accounts, but are instead holding their money in stablecoins… A powder keg.”

“[This] is why the current meteoric rise in stables could eventually unleash an unfathomable amount of buying power on to the market when/if BTC reaches attractive enough price levels.”

“If we do see demand pick up, there’s over one hundred and thirty billion dollars currently sitting on the sidelines already inside crypto’s ecosystem.”

Final Thoughts

Now just because the powder keg is there doesn’t mean that it will be unleashed in a vacuum….the Macro picture is still “risk-off” for the moment and bitcoin could set new lows….but, when risk appetite does come back (which could very well be sooner than many expect), digital assets could see a much bigger wave of investors jumping in this time around…

This information does not constitute a solicitation or an offer to buy or sell any securities. The mention of specific securities and sectors is not to be considered a recommendation by IDX Digital Assets, LLC . Charts, diagrams, and graphs, by themselves, cannot be used to make investment decisions.

© 2022 IDX Digital Assets, LLC. All rights reserved. The IDX and IDX Digital Assets logos, graphics, icons, trademarks, service marks and headers are registered and unregistered trademarks of IDX Digital Assets, LLC in the United States.

For those who are looking to learn more about Bitcoin, specifically how to talk to clients about the digital asset and it’s potential value in asset allocation models, we put together a high-level guide called “The Fiduciary’s Guide to Bitcoin and Blockchain”. Click on the button to the right to head to access the guide.